There are

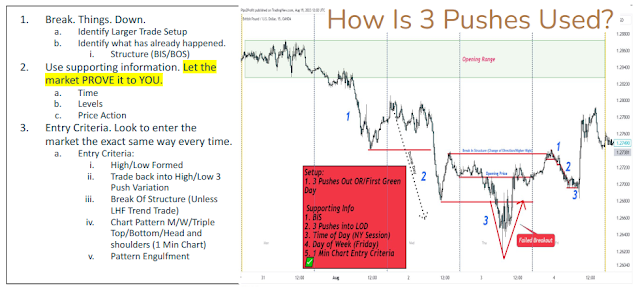

a lot of varying opinions about how the market moves, such as the

Wyckoff method, Elliott Waves, Stacey Burke Trading, Steve Mauro’s BTMM, etc. However, one

thing that all of these methods and models have in common is that the market moves in

three pushes.

In all timeframes price is always in some three-push pattern. Price develops in

fractals, and everything happening

on a higher time frame happens far more frequently on lower

time frames. Be aware of Other Time Frame (OTF) traders, of previous monthly, weekly,

and daily highs or lows. It helps us to identify

liquidity areas. Where are the entry and the stop loss orders? Where is the money, at the upper or at the lower

end of a range?

After the third push into one direction, price is going into consolidation. During the second push retail-traders believe that price is going to continue in the same direction, and everybody jumps in. This is the market maker’s trap to harvest entry and stop loss orders during consolidation. The third push is already part of a larger peak formation reversal pattern.

There are

four different variations of the three-push pattern that can be observed on all

timeframes:

1. 3 Levels, also referred to as ‘stair stepping’.

2. 3 Pushes:

a. Stair Step.

b. 1, 2, Pause, 3.

c. 1, 2, 3.

d. 1, Pause, 2, Pause, 3.

e. 3 Burst Impulse Candles.

3. 3 Pushes out of consolidation in any of the above listed variations.

4. Working Levels (3 Pushes)

a. Triple Tops.

b. Triple Bottoms.

2. 3 Pushes:

a. Stair Step.

b. 1, 2, Pause, 3.

c. 1, 2, 3.

d. 1, Pause, 2, Pause, 3.

e. 3 Burst Impulse Candles.

3. 3 Pushes out of consolidation in any of the above listed variations.

4. Working Levels (3 Pushes)

a. Triple Tops.

b. Triple Bottoms.